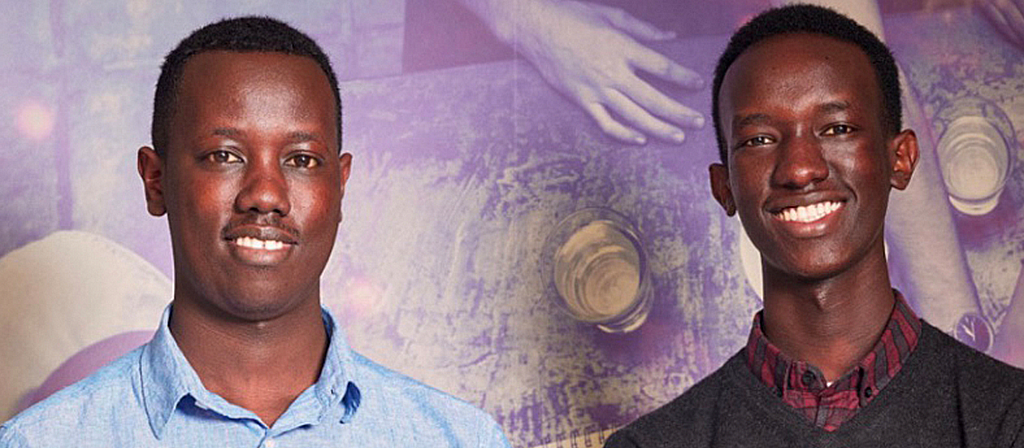

In African cities and towns, small businesses are the lifeblood of communities. From neighborhood kiosks to salons and freelance service providers, these businesses play a vital role in driving economic growth and creating opportunities. However, they all share a common challenge: managing their finances efficiently. This challenge formed the final year capstone project of one of ALU’s students and years later, it has blossomed into a startup called Kayko. Founded by two Rwandese brothers, Crepin and Kevin Kayisire, who graduated from the African Leadership University (ALU), Kayko is on a mission to simplify bookkeeping and empower businesses to take control of their finances; and this is just the beginning.

A Journey Rooted in Leadership Education

Crepin and Kevin’s journey from ALU students to successful entrepreneurs is nothing short of inspiring. ALU’s learning model, which emphasizes experiential learning, leadership and problem-solving, provided them with the foundation they needed to tackle real-world challenges. They vividly remember their first year in ALU academics, which to date still serve as their foundation of understanding business. “In my first year, which was structured around the Leadership Core, we experienced different concepts like learning how to lead, communicating for impact, making data driven decisions, running projects and identifying global challenges and opportunities. That formative first year experience helped me in conceptualizing our startup idea,” explains Crepin Kayisire. Like Crepin, all first year students at ALU are led through a series of foundational classes that help them discover what problem or challenge they are interested in exploring and equip them with the skills they need for the journey. Crepin and Kevin’s venture, Kayko, was born out of a deep understanding of the struggles faced by small businesses in their community; struggles which have set them on their journey of revolutionising small business finance in African communities.

Solving Real-World Problems

At the heart of Kayko is the aim to solve real-world problems for small businesses. Many of these businesses often lack the financial visibility needed to thrive. Before Kayko, some relied on basic bookkeeping methods like pen-and-paper ledgers or platforms which were not user friendly for the informal African context which SMEs operate in. With Kayko, these businesses can now digitize, monitor, and grow their finances effortlessly. The app offers a range of features that simplify the daily financial operations of small businesses and provide real time data that businesses can utilise. The cornerstone of ALU’s education has always been, ‘How do we develop lifelong learners and critical problem solvers, through our education’ and this has informed our emphasis on students pursuing mission and not majors. The missions based approach to ALU’s education empowers our students to not just learn about facts but do something about the facts they learn about.

Real Impact, Real Testimonials

The impact of Kayko is best understood through the stories of its users. Take Gisele Irasubiza, for example, a shop owner in Busanza, Kigali. She struggled with managing her inventory and understanding the financial health of her business. Kayko transformed her business operations:

“Now since she started using Kayko, she can keep a glance at all her different operations, no matter where she is, whether she’s in her shop, at her other job, or on the go. She has the app, and she can see all the different aspects of her business,” shares Gisele.

Gisele’s story is just one of many testimonials that highlight how Kayko is making a difference in the lives of small business owners.

A Bright Future Ahead

Kayko’s founders have ambitious plans for the future. They are working on enabling merchants to accept and make payments through the app, simplifying financial transactions even further. They are also planning to offer personalized loans based on the data collected from SMEs, helping them access the capital they need to grow.

While the dream is big, the founders emphasize the importance of patience and learning from experienced teams before diving into entrepreneurship. Their commitment to providing the best quality experience to their users in Rwanda before expanding to other regions reflects their dedication to making a lasting impact.

The story of Kayko, born from the experiences and education of Crepin and Kevin Kayisire at ALU, serves as an inspiring example of how innovation and dedication can transform small businesses and empower communities. By simplifying bookkeeping and providing tools for financial growth, Kayko is contributing to the success of small businesses across Africa.